Bedford Residents Face Tax Increase with Proposed Budget

August 11, 2024 – updated August 15, 2024

Bedford residents will likely face a tax increase for the next fiscal year (FY 2024-2025), based on proposed budget numbers presented to City Council by City Manager Andrea Roy. She stated that, as presented, the budget would increase by 3.08%. In her presentation to City Council at Thursday’s work session, Roy and her staff are proposing a budget of $97.57 million, which is a $2.92 million increase over this year (FY 2023-2024).

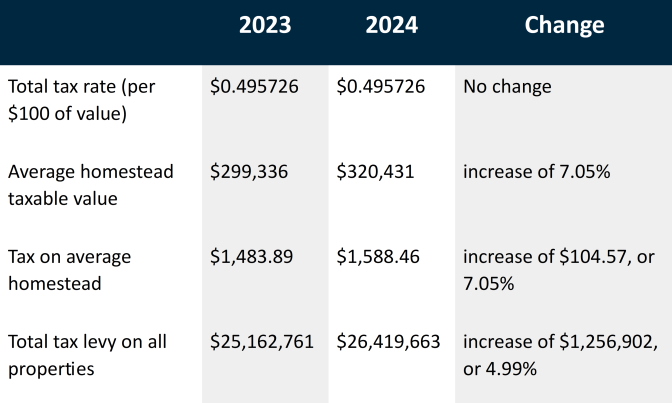

While Roy, in her presentation, said the “tax rate” will remain at $0.495726 per $100 assessed valuation, “the same rate” as this year, the numbers she gave would indicate an increase in taxes, which would come from the growth of the City’s overall “taxable values.” The “taxable values grew by 6.09% or $385 million,” Roy stated. So, while the City’s “tax rate” would remain the same, higher taxes would still be paid by City residents based on increases in property values. Both figures are applied to determine the amount of City taxes paid by residents through property taxes ($0.495726 x each $100 of Appraised Property Value).

According to a City of Bedford press release, since this proposed tax rate is lower than the “voter-approval tax rate,” an election is not required where residents vote to “accept or reject” it.

City Council has scheduled a September 10 public hearing at 6:00pm for residents to comment on the proposed tax rate. The hearing will be held in the Council chamber at City Hall.

Tax Rate Chart courtesy of City of Bedford

The City’s tax base (or net taxable value) grew by 6.09% to $6.72 billion, she stated, which includes a 7.25% increase in residential property values, a 0.96% increase for commercial assets and 9.28% for industrial valuations.

The budget increase, Roy explained in a statement issued prior to the meeting, is “primarily related to one-time items or capital projects.” She said in the statement that the budget, as proposed, is intended to “provide quality services that reflect the community’s goals and vision” and “is developed in alignment with the City Council’s strategic plan” and “the desires of Bedford residents.”

Dramatic changes at the Tarrant Appraisal District (TAD), which were approved Friday, could force the City and other local taxing entities to start raising the Residential Tax Rate to compensate for the financial demands of future budgets. Deputy City Manager Caryn Riggs, in a more comprehensive segment of the City’s presentation to the Council, explained that Residential Property Values will “hold flat until 2027” with TAD going from annual appraisals to appraisals “every other year, on odd years.” But, she said, “They will reappraise multifamily, they will reappraise commercial and any new value added,” such as “any new addition to your home.” This modification in TAD’s process, she sarcastically understated, could “make budgets in the next couple of years a little challenging.”Riggs added TAD’s changes will introduce further challenges for the City in determining the annual budget with property values now frozen at a 5% limit for increases, not for each year, but at the same threshold for two years at a time.

Budget Breakdown

For the coming year, Riggs listed several items that contributed to the increase in the budget. An “across the board” 3% cost of living increase for employees, topped her list, followed by “funding public safety step increases” and higher general expenses, such as the cost of fuel, mowing services and utilities.” Riggs also pointed to increases in premiums for property and worker’s compensation insurance, as well as funding for operating the new Senior Center at the old YMCA, once it opens after the ongoing renovation.

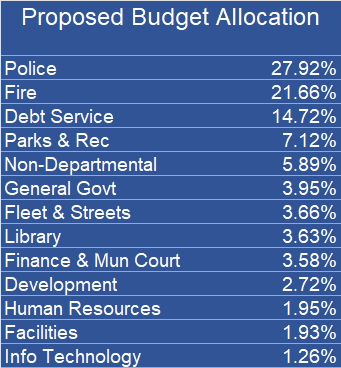

Based on figures provided by Riggs, each Bedford household will pay an average of $1,588.46 to support the City’s budget in the coming year. That figure is based on the Average Taxable Value of $320,431 per household, according to her numbers. Of that amount, nearly 28% will fund the police, 22% will go to pay for the fire department and 15% for debt service.

Proposed Budget Allocation Figures courtesy of City of Bedford

No time to follow news developments in the Bedford Journal Project?

The Project introduces a free email newsletter with its feature articles delivered to your inbox at the end of each month.

Visit the ‘About’ page to read more and sign up!